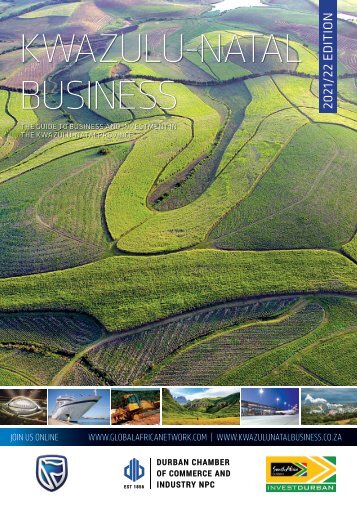

African Business 2021

- Text

- Africa

- Markets

- Resources

- Minerals

- Technology

- Trade

- Integration

- Development

- Investment

- Business

- Regional

- Kenya

- Global

- Digital

- Mobile

- Infrastructure

- Sector

- Economic

- Countries

- African

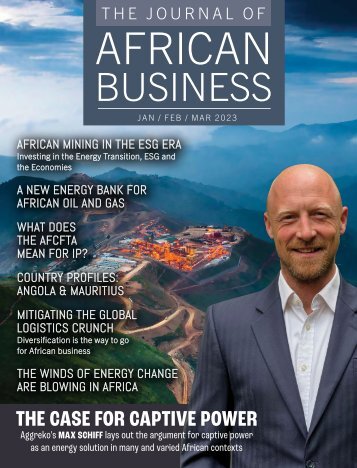

SPECIAL FEATURE A new

SPECIAL FEATURE A new era in trading has begun The African Continental Free Trade Area offers enormous opportunities for expansion. On 1 January 2021 a new era in African trade began. All but one of Africa’s 54 countries have signed on to the African Continental Free Trade Area (AfCFTA) and 34 countries have ratified it. Implementation was postponed for six months because of Covid-19. Eritrea is the outlier but fully 41 members have already submitted tariff reduction schedules, suggesting that there is an appetite for getting down to detail on this agreement, rather than leaving it in “talking shop” mode. Tariffs on 90% of items are due to be reduced in the next decade. More time has been allocated to poorer countries to allow them to adapt, 7% of items will take longer and 3% can stay protected. The African market of 1.3-billion people is expected to grow to 2.5-billion by 2050 but the key statistic targeted by AfCFTA is intra-African trade. If the agreement is to have meaning, then the insipid figure of 16.6% in 2017 must grow. This compares with 69% in Europe and 59% in Asia (United Nations Conference on Trade and Development and Brookings Institution). Exports to the rest of the world made up between 80% and 90% of Africa’s total trade from 2000 to 2017 (UNCTAD). In 2019 only about 27% of South Africa’s exports were delivered to the rest of the continent. Just four countries currently account for 41.7% of intra-African trade, South Africa, Namibia, Nigeria and Zambia, according to the Export Credit Insurance Corporation of South Africa (ECIC). The ECIC has invested in the African Export Import Bank in an effort to boost intracontinental trade to 0-billion. The South Africa-Africa Trade and Investment Promotion Programme has the same goal. Areas with existing regional trade blocs that function well – such as the Common Market for Eastern and Southern Africa (COMESA) and the Southern African Development Community (SADC) – will likely be the quickest to gain from AfCFTA. These regional groupings are best placed to start thinking beyond tariffs: more efficient customs posts, lower air-freight costs, better-run ports, regulatory alignment and improved rail and road infrastructure. Railways, roads and ports are not the only kinds of logistics infrastructure that is needed. South African-based investment fund African Rainbow Capital is a participant in a 0-million AFRICAN BUSINESS 2021 10

SPECIAL FEATURE fund that includes investment in cold-storage facilities in East Africa in its portfolio. Donald Trump did not pay much attention to Africa when he was president of the US but he was strongly in favour of bilateral, rather than regional agreements so it is surprising that the African Growth and Opportunity Act (AGOA) survived the Trump years. The deal, which gives duty-free access to about 6 500 products from 39 Sub- Saharan countries, is due to expire in 2025. By then AfCFTA will have been operating for four years and the region’s ability to negotiate as a collective should be stronger. As much as Africa countries’ trade within the continent will grow, exports will remain key to adding value and attracting good prices. Trade between the US and Africa in 2018 was valued at .2-billion. Namibia achieved a breakthrough in 2020 when, after nearly two decades of negotiations, 25 tons of the African country’s beef was shipped duty-free to the US. Under AGOA, Namibia may send the US up to 860 tons of beef but the fact that negotiations took so long points to the fact that the treaty is not a panacea. A possibly even more significant event took place in 2019 when the same producer, MeatCo, a Namibian stateowned entity, exported some meat to China. Trade finance In preparation for AfCFTA, development finance institutions and banks have been developing methods of trading in local currencies, rather than hard currencies like the US dollar. The African Virtual Trade-Diplomacy Platform (AVDP) is a privatesector initiative by more than 20 companies (in partnership with the AU Commission) which will support AfCFTA by enabling member states to participate effectively and securely. Banking groups such as Citi have been investing heavily in digital platforms related to payments infrastructure. Many African traders already do their banking on hand-held devices and so the market is ready for more innovation in taking digital payments further into the world of trade. Developing reliable cross-border payment platforms will be vital in supporting increased intra-African trade. Esther Chibesa is the Managing Director, Treasury and Trade Solutions (TTS) Sub-Saharan Africa Cluster Head. Navigating challenges through innovation Citi’s trade business has evolved in line with the fundamental changing market needs to address a wide range of financing requirements from the basic to the more complex structures in a domestic and international trade environment. At Citi, we are always looking to help our clients navigate the current future challenges through innovation and a foundation in digitally-enabled strategies. We have focused on resilience in three ways: financially, by focusing on working capital needs within the buyer and seller ecosystem and longer-term financing needs; operationally, by helping clients de-risk supply chains to provide long-term sustainable growth: and technologically, by offering the latest technology to improve speed, accuracy, data and security of clients’ trade. Fundamentally, as Citi operates more globally than any other financial institution, providing a standardised yet locally sensitive offering to clients, wherever they do business, is an enabler of progress. As our clients shift trade patterns and flows around the world, we are there to provide support. ECIC provides export credit and investment guarantees, stepping in where commercial banks might be risk-averse to support private investment. The European Investment Bank is the investment arm of the European Union and often partners with African institutions. China has a wide range of financial entities which are active across a range of sectors in Africa. These entities include the China Development Bank (CDB), the China International Trade and Investment Corporation (CITIC), China Export and Credit Insurance Corporation (CECIC), China Export Credit Insurance Corporation (Sinosure) and the China Export-Import Bank. ■ 11 AFRICAN BUSINESS 2021

- Page 1 and 2: RTHERN CAPE SINESS AFRICAN BUSINESS

- Page 3 and 4: YOUR BUSINESS IS GLOBAL. YOUR BANK

- Page 5 and 6: DELIVER AN UNFORGETTABLE RETAIL EXP

- Page 7 and 8: Interoperability and the Rapid Paym

- Page 9 and 10: AFRICA OVERVIEW in the Central Afri

- Page 11: AFRICA OVERVIEW Development Communi

- Page 15 and 16: SPECIAL FEATURE than one-billion mo

- Page 17 and 18: FOCUS Vedanta Zinc International pr

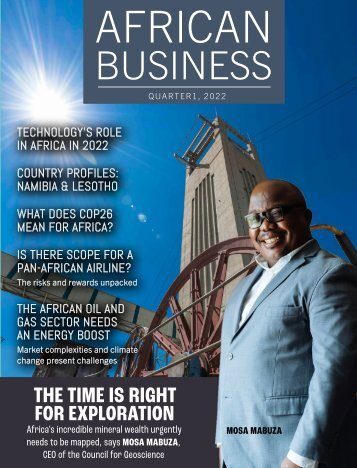

- Page 19 and 20: SPECIAL FEATURE Exploration expendi

- Page 21 and 22: SPECIAL FEATURE in recent years as

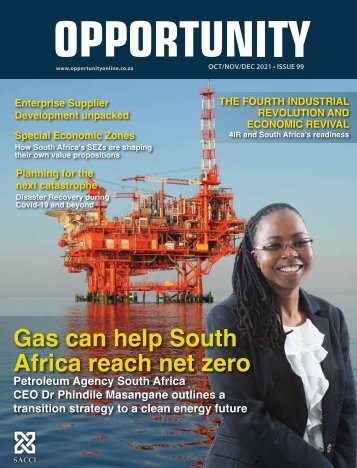

- Page 23 and 24: FOCUS Petroleum Agency SA: promotin

- Page 26 and 27: I @CGS_RSA I I

- Page 28 and 29: SPECIAL FEATURE Neighbours working

- Page 30 and 31: Sunset at Tsavo East National Park,

- Page 32 and 33: OVERVIEW Agriculture Uganda has a n

- Page 34 and 35: OVERVIEW Energy An ECCAS interconne

- Page 36 and 37: Testing conditions for a successful

- Page 38 and 39: OVERVIEW Manufacturing A focus on m

- Page 40 and 41: OVERVIEW Transport and logistics Op

- Page 42 and 43: OVERVIEW Aviation Consolidation is

- Page 44 and 45: OVERVIEW Tourism Recovery from Covi

- Page 46 and 47: OVERVIEW Information and Communicat

- Page 48 and 49: OVERVIEW Banking and financial serv

- Page 50 and 51: The Grand Ethiopian Renaissance Dam

- Page 52 and 53: Elections were held across the regi

- Page 54 and 55: Elections in the Central African Re

- Page 56 and 57: Region: Southern Africa Mozambique

- Page 58 and 59: South Africa An extensive renewable

- Page 60: © 2021 Citigroup Inc. Citi, Citi a

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...