Blue Chip Issue 85

- Text

- Financial services

- Capital

- Fpi

- Asset management

- Investment

- Stocks

- Financial planners

- Financial

- Global

- Investments

- Asset

- Wealth

- Planner

- Portfolio

- Retirement

- Hedge

- Advisors

- Funds

BLUE CHIP INVESTMENT THE

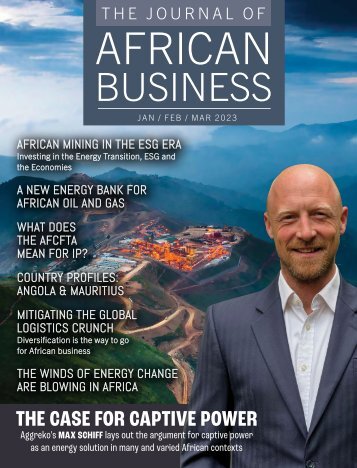

BLUE CHIP INVESTMENT THE UNLOVED OF THE UNLOVED Why bargain hunters should be shopping in Europe, not the US. Value stocks in Europe are the “unloved of the unloved”, but they have offered more growth than growth stocks. Here, three charts tell the story. The value investor has become something of an endangered species over the last decade, pushed to the sidelines of a market fixated on seeking never-ending growth in areas such as technology. The underperformance of the value investment style has been much discussed, and – barring a relatively short rally this year – mostly painful for deep value investors such as us on the value investment team at Schroders. The result is a wide chasm in the valuations of the cheapest shares and the most expensive. This has not gone unnoticed. Indeed, one of our favourite columnists in the FT recently, Robert Armstrong, said, “Value stocks look like a heck of a value right now!” He pointed out that the ratio of the price/earnings (P/E) multiples of growth and value stocks in the US was now at a 20-year low. This is true and compelling. But there is a place where the differential is even more pronounced: Europe. And what’s most surprising of all, is that – counterintuitively – Europe’s cheapest companies have been delivering higher profit growth than Europe’s most expensive companies. Three charts that tell the story The first chart looks at the valuation dispersion between growth and value in Europe, using data from Morgan Stanley that combines three valuation measures: price/earnings, price/book (P/BV) and price/ dividend (P/Div). While the similar value spread in the US is undoubtedly cheap, the data in Europe is eye-wateringly so. Europe has gone lower than the dotcom nadir around the turn of the century and the recent bounce still leaves a very long way to go.

INVESTMENT BLUE CHIP Valuations of value vs growth are still near all-time lows The two points above show that there are similar broad themes in the US and Europe, but that they’re more extreme in the latter. However, the chart below is what makes the first two points seem completely crazy. It shows the earnings-per-share growth of Eurostoxx value and growth indices. Value shares have outgrown growth Source: Morgan Stanley. 21 June 2022. While this makes the relative case for value in Europe, let’s not forget the absolute one. Taking the MSCI Europe indices as a blunt proxy for European value and growth, we see that the broad MSCI Europe index is trading on 12-month forward P/E ratio of 15.4, MSCI Europe Growth is on 20.1 and MSCI Europe Value is on just 10.8 (according to data from Bloomberg). A forward P/E ratio is a company’s share price divided by its expected earnings per share over the next 12 months. Using slightly different data from Eurostoxx, we see value shares in Europe are currently trading on lower PEs than they were five years ago (see below). Source: Schroders It has been a brutal few years for cheap stocks in Europe. There are very few, if any, parts of developed market equities that the market is so pessimistic about that they’ve de-rated over the last five years – whether in absolute or relative terms. (A derating is when the P/E ratio of a stock contracts due to a bleak or uncertain outlook.) Just to really put the boot in, the US’s Russell 1 000 value index is on a 12-month forward P/E of 16.5, while the equivalent in Europe is on around 11. This enormous differential shows that a cheap stock in the US is held in much higher regard than a cheap stock in Europe; value stocks in Europe are the unloved of the unloved. Source: Bloomberg. Schroders as at 13 January 2022. Over the last five years, Europe’s cheapest companies have delivered more profit growth than their growth counterparts. This is a distinctly European phenomenon and isn’t what you see in other developed markets such as the US, where you have some premium profit growth from growth stocks. Cynics could say that this is down to the effect of starting from a low base, as the chart starts in 2017 just as the mining cycle turned positive. But we’ve ran this over multiple time periods, and you get the same result. It is also worth noting that the favourable earnings profile for value was in place before the Covid-19 pandemic. It’s not all driven by the profit rebound, commodity inflation and interest rate benefits that have boosted value following the pandemic. So over that five-year period the real growth stocks in Europe, in terms of fundamentals at least, have been the value stocks. Bring this all together and there’s a compelling reason to believe value in Europe is looking attractive, almost through absolute valuations, record levels of relative valuation discount to growth and positive relative earnings momentum. This isn’t really a widely shared view, however. Indeed, looking at investor flows and allocations, Europe is one of the most overlooked equity markets in the world. Perhaps not for long. Ben Arnold, Investment Director, Schroders For professional investors and advisors only. The material is not suitable for retail clients. We define “professional investors” as those who have the appropriate expertise and knowledge eg asset managers, distributors and financial intermediaries. Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise. The views and opinions contained herein are those of the individuals to whom they are attributed and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. in England and Wales) which is authorised and regulated in the UK by the Financial Conduct Authority and an authorised financial services provider in South Africa FSP No: 48998

- Page 1: Issue 85 • Oct/Nov/Dec 2022 BLUE

- Page 4: CONTENTS ISSUE 85 OCT/NOV/DEC 2022

- Page 7 and 8: JEAN MINNAAR - MANAGING DIRECTOR -

- Page 9 and 10: We look forward to seeing you at th

- Page 11 and 12: A massive thank you to all our atte

- Page 13 and 14: Connect with a Momentum Financial A

- Page 15 and 16: Advice software. Built for better p

- Page 17 and 18: The power of balance Equilibrium is

- Page 20 and 21: BLUE CHIP COLUMN PASSION FOR OUR PR

- Page 22 and 23: BLUE CHIP FPI THE VALUE OF A FINANC

- Page 24 and 25: BLUE CHIP FPI FPI as our members ar

- Page 26 and 27: BLUE CHIP FPI B-BBEE points to cons

- Page 28 and 29: BLUE CHIP FINANCIAL PLANNER OF THE

- Page 30 and 31: BLUE CHIP FINANCIAL PLANNER OF THE

- Page 32 and 33: The smart solution for financial ad

- Page 34 and 35: Tax Planning 2022

- Page 36 and 37: BLUE CHIP FINANCIAL PLANNER OF THE

- Page 38 and 39: BLUE CHIP INVESTMENT RISKY BUSINESS

- Page 40 and 41: BLUE CHIP INVESTMENT Upside without

- Page 42 and 43: BLUE CHIP DFM Choosing a Discretion

- Page 44 and 45: BLUE CHIP INVESTMENT Imagine the fu

- Page 46 and 47: BLUE CHIP OIL AND GAS Good news for

- Page 50 and 51: BLUE CHIP HEDGE FUNDS Is there stil

- Page 52: BLUE CHIP HEDGE FUNDS For those who

- Page 55 and 56: INVESTMENT BLUE CHIP partnering wit

- Page 57 and 58: ESTATE PLANNING BLUE CHIP Do you ha

- Page 59 and 60: NOMURA ASSET MANAGEMENT Beating the

- Page 61 and 62: COMPREHENSIVE ASSISTANCE WITH ALL K

- Page 63 and 64: INVESTMENT BLUE CHIP CoreShares Inv

- Page 65 and 66: INFLATION BLUE CHIP Chart 2: Growth

- Page 67 and 68: 99.5% OF THE WORLD’S MARKETS ARE

- Page 69 and 70: FINANCIAL PLANNING BLUE CHIP The tw

- Page 71 and 72: YOUR BUSINESS IS ABOUT CREATING AND

- Page 73 and 74: BLUE CHIP PORTFOLIO FINANCIAL PLANN

- Page 75 and 76: Independent Specialist Advisers Spe

- Page 77 and 78: ESTATE PLANNING BLUE CHIP savings a

- Page 79 and 80: LEGAL BLUE CHIP If you fail to plan

- Page 81 and 82: PRIVATE CLIENT HOLDINGS IS AN AUTHO

- Page 83 and 84: TECHNOLOGY BLUE CHIP approach is va

- Page 86 and 87: Momentum Financial Planning is recr

- Page 88 and 89: BLUE CHIP RISK MANAGEMENT THE PANDE

- Page 90 and 91: BLUE CHIP COACHING Shifting the way

- Page 92: WE LOOK FORWARD, SO YOU KNOW WHO TO

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...