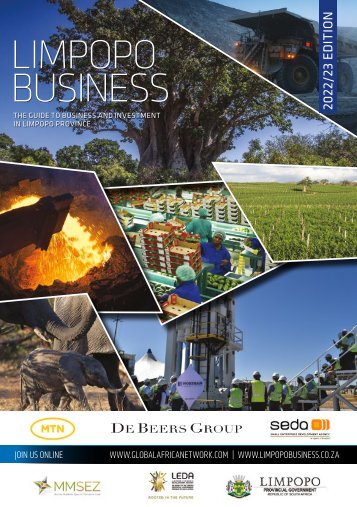

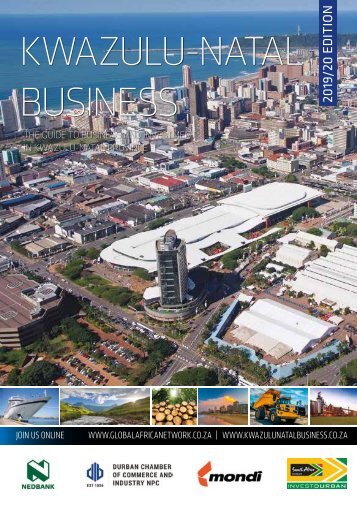

KwaZulu-Natal Business 2022-23

- Text

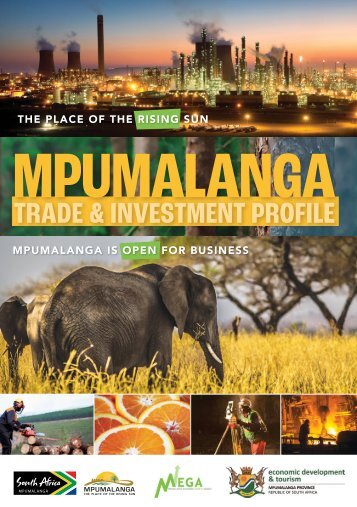

- Trade

- Africa

- Invest

- Investment

- Business

- Kwazulunatal

- Kzn

- Terminal

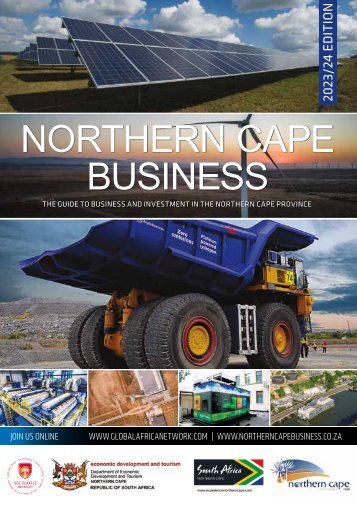

- Industrial

- Province

- Provincial

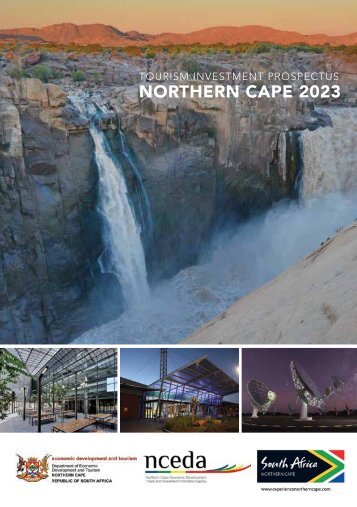

- Tourism

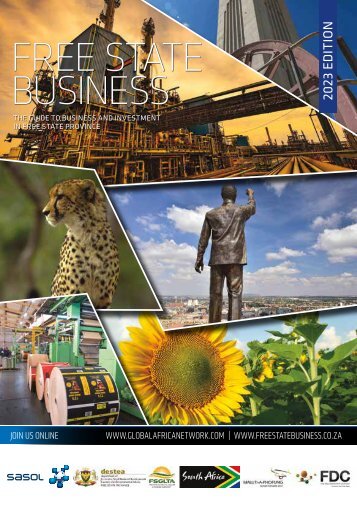

- Economic

- African

- Sector

- Richards

- Durban

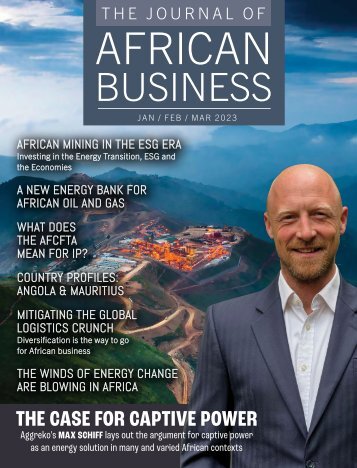

OVERVIEW Manufacturing

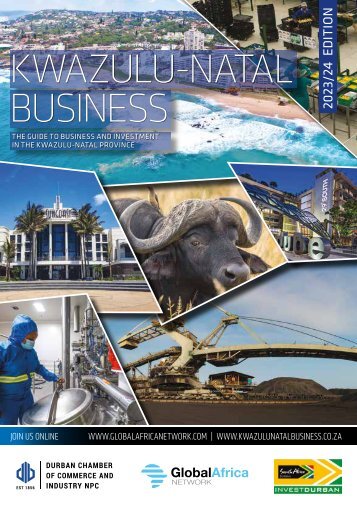

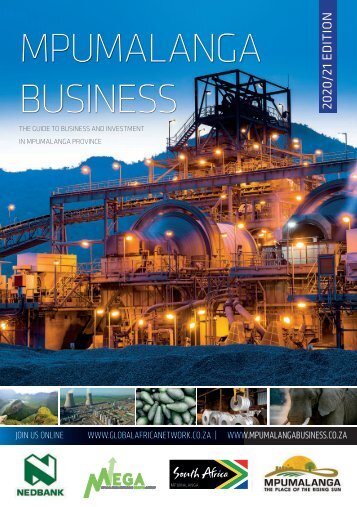

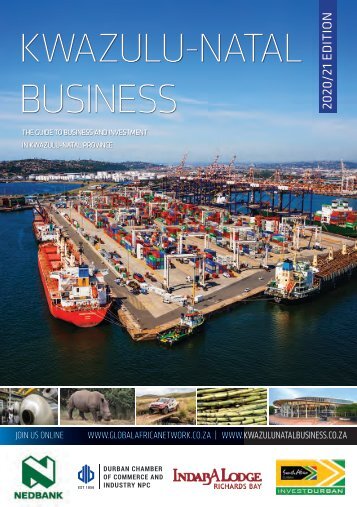

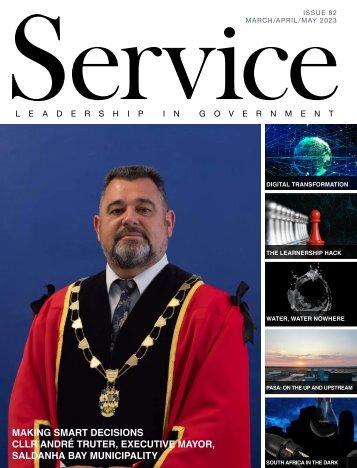

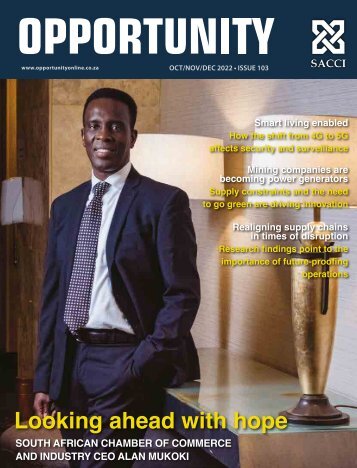

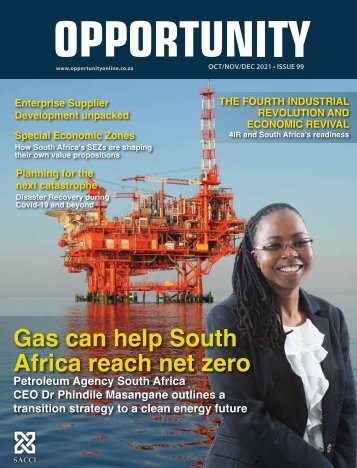

OVERVIEW Manufacturing Sappi’s giant plant at Umkomaas is set to grow again. SECTOR INSIGHT Hulamin is supplying a US electric car manufacturer. EBH has extensive facilities in the Port of Durban. Sappi’s massive Saiccor Mill on KwaZulu-Natal’s south coast is on course to grow even bigger. The company is conducting feasibility studies to construct a plant to produce furfural. The pilot plant will be erected in the course of 2022. The Saiccor mill has the capacity to produce approximately 800 000 tons of dissolving pulp per annum, mostly export. Capacity will rise above 900 000 tons once an expansion project is complete. Aluminium producer Hulamin experienced reduced demand during the Covid-19 lockdowns but has secured a number of good orders, including to supply product to a US manufacturer of electric vehicles. Hulamin had previously laid off some workers and closed one of its factories in another province. The company believes that its restructuring is working well, and its beverage business is thriving. Hulamin also makes rolled products at Edendale, Pietermaritzburg and at Camps Drift. Dube TradePort attracted R7-billion in private and public sector investment between 2012 and 2019 and, with its ideal position for logistics operations, is expected to attract much more. The province’s other Special Economic Zone (SEZ), the Richards Bay Industrial Development Zone (RBIDZ), is attracting investments in a wide range of sectors. Cipla, the Indian manufacturer of generic drugs, is building a new facility at Dube TradePort to complement its existing factory in Durban. LG Electronics South Africa has opened a R21-million factory and distribution centre in Cornubia, north of Durban. The manufacturing sector contributes 17.7% to the provincial Gross Domestic Product (GDP) of KwaZulu-Natal. The strongest ONLINE RESOURCES Aluminium Federation of South Africa: www.afsa.org.za Chemical and Allied Industries’ Association: www.caia.co.za Enterprise iLembe: www.enterpriseilembe.org.za export sectors are base metals (32% including aluminium), mineral products such as ores, vehicles and chemical products. New opportunities in the Blue economy (shipbuilding and maintenance, oil-rig repair and servicing) and the Green economy (solar panel manufacture, solar, biogas and wind energy plant construction, management and maintenance, heating and cooling devices) are set to grow in KwaZulu-Natal with the allocation of geographical hubs to support these sectors, and the introduction of policies and incentives designed to make them competitive. Two large oil refineries and a sophisticated sugar milling and refining industry underpin provincial chemical manufacturing although the SAPREF refinery announced a suspension of operations in February 2022. The chemicals and petrochemicals subsector makes up 17% of the manufacturing output of KwaZulu-Natal, with industrial chemicals accounting for nearly a third. Steel and aluminium are other heavy manufacturing products. Newcastle is a chemical manufacturing hub. ■ KWAZULU-NATAL BUSINESS 2022/23 42

31391 Commercial Banking Nedbank partners with the automotive industry to drive competitiveness amid turbulence By Amith Singh, National Manager Manufacturing The South African automotive industry, which generates around 18,7% of domestic manufacturing output, plays a significant role in our country’s economy, with a GDP contribution comparable to that of mining and agriculture. The 2022 Automotive Export Manual released by the Automotive Industry Export Council earlier this year also revealed that vehicle and automotive component exports increased by 18,1% in 2021 to comprise 12,5% of total South African exports. Unfortunately, the industry has been hit hard by recent global and local events, including global supply chain disruptions and operational efficiencies at South African ports that are well below international standards, further exacerbated by riots and cyberattacks. More recently the flooding in automotive-intensive KwaZulu- Natal and onerous load-shedding schedules resulted in the manufacturing production figures released for April 2022 showing a substantial decline of 7,8% year-on-year. With most of these setbacks hopefully behind us, and efforts being made to stabilise electricity supply and improve the situation at our ports, savvy automotive manufacturing firms should consider the five trends that Deloitte’s 2022 manufacturing industry outlook pinpointed to watch. With business agility critical for organisations to operate through unprecedented turbulence, the report identifies key strategies to drive competitiveness. These include embracing technology to create more connected, reliable, efficient and predictive processes; carefully reviewing cyberdefences and resilience in the event of cyberattacks; and closely monitoring the fast-evolving environmental, social and governance (ESG) landscape and adjusting operations accordingly. Proactive approaches to these challenges will help automotive manufacturers mitigate setbacks while creating a competitive advantage. Nedbank’s deep understanding of the manufacturing industry has enabled us to develop tailor-made solutions in this field, making us the expert strategic banking partner to grow our clients’ businesses. The bedrock of our manufacturing portfolio is the deep, lasting and value-adding relationships we develop with our clients and key industry stakeholders. These solutions are underpinned by our continuous drive to innovate our financial and administrative functions, enabling you to take your business to the next level. Through this profound insight we provide bespoke, innovative financial solutions to help grow our clients’ businesses and strengthen their competitiveness in the market. For example, because we know that present macroeconomic challenges coupled with power supply issues lead to having cash flow constraints that could prohibit delivery and growth, we have a range of solutions to mitigate that risk. Similarly, as the green bank, we offer a comprehensive range of solutions to promote the sustainability of clients’ businesses, giving them the competitive advantage that is so vital in the market. Our vast experience in global trade enables quicker, more efficient cross-border transactions when importing and exporting, and easy access to funds smooths out cash flow fluctuations between production cycles, enabling clients to take advantage of discounts and bulk offers. But the real value we offer is our partnership approach, which means clients benefit from a committed partner with industry expertise who will advise on growth, investment and financial strategies based on our deep insight into each client’s unique financial situation. For more information about our specialist manufacturing services, email us at manufacturing@nedbank.co.za. Singh is Nedbank Commercial Banking’s national manager for the manufacturing sector. He holds a degree in business management from the University of Cape Town, a postgraduate degree in sales management, and is a qualified Neethling Brain Institute practitioner. He has been in banking for 19 years. Nedbank Ltd Reg No 1951/000009/06. Licensed financial services and registered credit provider (NCRCP16).

- Page 1 and 2: KWAZULU-NATAL BUSINESS 2022/23 EDIT

- Page 3 and 4: 1 0 1 1 0 1 1 0 1 BUY LOCAL INVEST

- Page 5 and 6: ABOUT THE DURBAN CHAMBER OF COMMERC

- Page 7 and 8: DURBAN ICC AFRICA’S LEADING CONVE

- Page 9 and 10: KwaZulu-Natal Business A unique gui

- Page 11 and 12: SPECIAL FEATURE King Shaka Internat

- Page 13 and 14: SPECIAL FEATURE The decision to bui

- Page 15 and 16: MTN - trusted by businesses and gov

- Page 17 and 18: FOCUS Helping small business get co

- Page 19 and 20: Bill Thrive with productivity that

- Page 21 and 22: SPECIAL FEATURE is a partner alongs

- Page 23 and 24: Offering a wide range of services t

- Page 25 and 26: FOCUS An interactive website propel

- Page 27: FOCUS included as part of the South

- Page 30 and 31: OVERVIEW Agriculture Packaging firm

- Page 32 and 33: OVERVIEW Forestry and paper A campa

- Page 34 and 35: OVERVIEW Engineering UCL’s expans

- Page 36 and 37: FOCUS Offshore exploration will ben

- Page 38 and 39: OVERVIEW Energy eThekwini plans to

- Page 40 and 41: OVERVIEW Water Bulkwater schemes ar

- Page 42 and 43: OVERVIEW Tourism Resumed flights au

- Page 46 and 47: OVERVIEW Education and training New

- Page 48 and 49: OVERVIEW Development finance and SM

- Page 50 and 51: OVERVIEW Banking and financial serv

- Page 52: Centralise and integrate management

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...