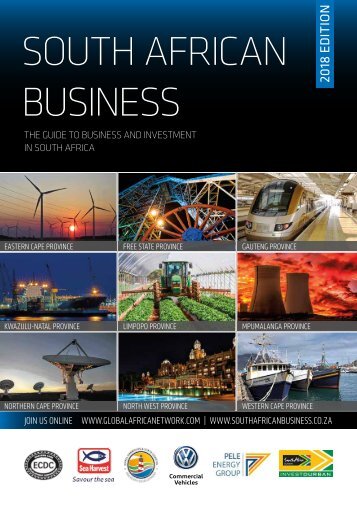

South African Business 2018 edition

- Text

- Aerotropolis

- Industry

- Urban

- Densification

- Water

- Sustainable

- Development

- Regional

- Interview

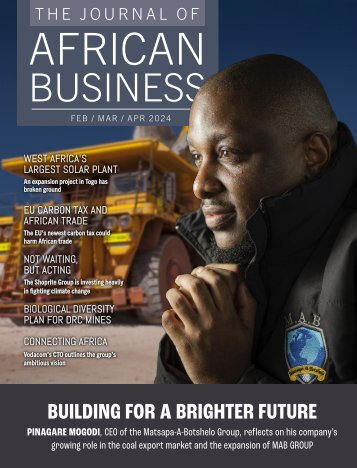

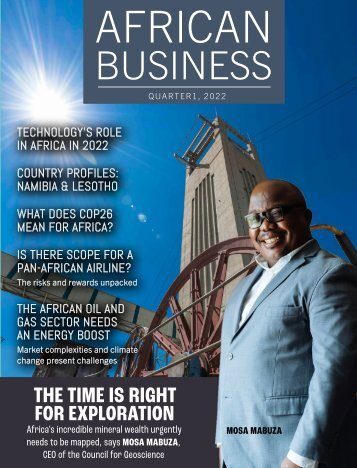

- Africa

- Investment

- Business

- African

- Economic

- Sector

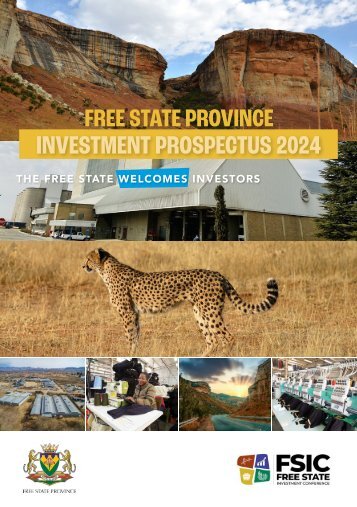

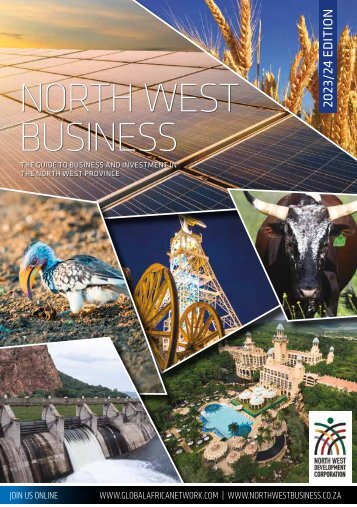

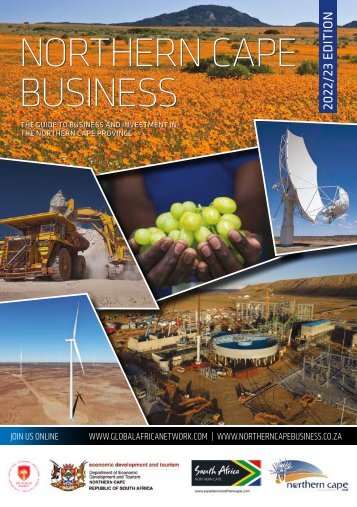

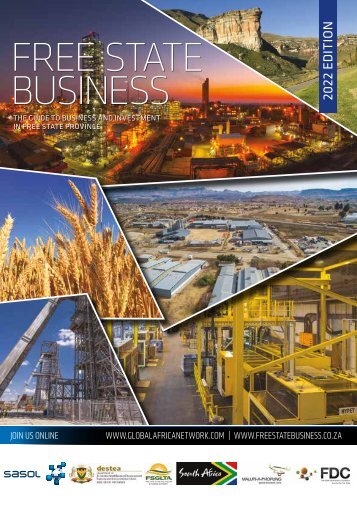

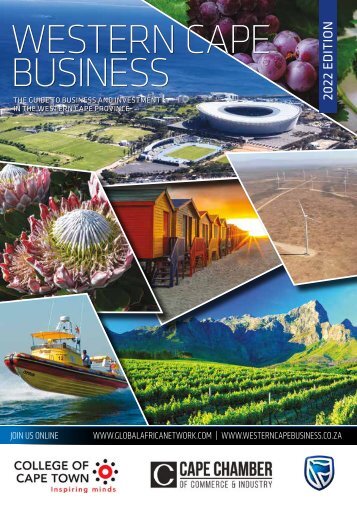

- Province

- Projects

- Manufacturing

- Infrastructure

- Coastal

OVERVIEW Agriculture

OVERVIEW Agriculture Agriculture companies are active on the stock exchange. When South Africa’s first alternative stock exchange in South Africa started trading in February 2017, the first listing was agricultural company Senwes and its holding company. On the JSE, agricultural companies make up 4.3% of market cap. Senwes has been described as a “rock solid, conservatively run agricultural titan” (Anthony Clark) while Kaap-Agri, which listed on the JSE in June 2017, might be, according to Investors Monthly, “the best retailing conglomerate in South Africa”. Afgri, biggest of the former co-operatives that are now multi-dimensional companies, has delisted from the JSE but in 2017 bought the South African Bank of Athens. The JSE has also launched a wool futures contract as the sector strives to add 25-million kilograms to the existing crop of about 44-million kilograms. Zeder Investments is the agricultural arm of investment holding company PSG Group (which has become well known through Capitec Bank and Curro schools). Zeder has been increasing its stake in agricultural companies, most notably Capespan. Capespan has a turnover of R7.6-billion across three divisions: farms, logistics and fruit. Zeder also owns 27.1% of Pioneer Foods which makes and distributes many big food and drink brands across Southern Africa, including Weet-Bix, Liqui-Fruit, Ceres, Sasko and White Star. The company has an SECTOR INSIGHT A record maize harvest is boosting exports. • Land under macadamia nuts is increasing rapidly. annual turnover of R20-billion and it has two Bokomo facilities producing wheat biscuits, cereal and muesli in the United Kingdom. These facts give an indication of the large influence which the agricultural sector has in South Africa. When national agricultural output surged in mid-2017 on the back of good rains and harvests, the country was lifted out of the technical recession into which it had fallen in the first quarter. A maize crop of 16.4-million tons for 2016/17 means a surplus SOUTH AFRICAN BUSINESS 2018 60

OVERVIEW of about four-million tons, definitive proof that the long drought which hit South Africa is over, at least in the central and northern regions. The Western Cape drought continues. The Land Bank intends to put aside R1-billion in supporting black agricultural entrepreneurs. The hope is that by making the sector more inclusive, long-term food security will be ensured. Fruit, sugar and wine make up about 7% of the country’s total export basket. Avocadoes, tomatoes and macadamias are among other important export crops. More than 50% of agricultural export is made up of processed agricultural products, a promising development for the future of agriprocessing. National trade policy strategies are intended to enhance this trend. Primary agriculture provides 5% of formal employment in South Africa. Several of the Special Economic Zones around South Africa either have or will in the future have agri-processing facilities. Examples include existing tomato paste and dairy facilities at Coega IDZ and plans to develop the SEZ at Harrismith (Maluti-A-Phofung) into a hub for agri-processing. Several former farmers’ cooperatives are now substantial agri-businesses. Most have a specific geographic and farming sector focus (BKB is strong in the eastern Free State and Eastern Cape and concentrates on wool and mohair) while others like Afgri have a national presence. Senwes has a strong grain division and it controls 68 silos. Its operations are run from Klerksdorp in the centre of the country in North West Province. Other companies include NTKLA (Limpopo), GWK (Northern Cape), Klein Karoo Agri, VKB (eastern Free State and Limpopo), Kaap Agri (from the Boland to the Eastern Cape and up to Namibia), SSK (Overberg) and TWK (KZN and Mpumalanga). Crops A total of 70% of South Africa’s grain production is maize, which covers 60% of the cropping area of the country. The North West Province produces one third of South Africa’s maize and about 15% of its wheat. The Free State is the country’s largest supplier of wheat (37%) and maize (34%). The Western Cape has 350 000ha of wheat-producing land. Macadamia nuts is one of the fastest-growing sectors in South Africa. Almost all of nuts produced are exported and the global market is expanding every year: nearly 2 000ha are added to the land under macadamias every year. Mpumalanga and Limpopo provinces are big nut-growing provinces. Another sector enjoying a boom (mainly because of Chinese demand) is avocadoes, with almost 1 000ha per year of new land being planted. The South Africa feed industry has an annual turnover of about R50-billion with most of the raw material being soya and maize. Two of the country’s big three sugar producers (Illovo Sugar and Tongaat Hulett) each shut down one of their mills because of the extended drought and the broader trend for sugar production and the amount of land under sugar cane is downwards. The prospect of a sugar tax will not help sales. Both of these companies have diversified portfolios with Tongaat Hulett active in property in KwaZulu-Natal. The other big sugar company, TSB Sugar, has been acquired by RCL Foods. The Free State Province supplies significant proportions of the nation’s sorghum, sunflower, potatoes, groundnuts, dry beans, and almost all of its cherries. Barley and canola are produced in the Western Cape. Products distinctive to South Africa, such as rooibos tea (Western Cape) and marula berries (Limpopo) hold great potential to capture niche markets internationally. Fruit South Africa is famous for its fruit, of which 35% is citrus, 23% subtropical and nuts, 26% pome fruit, 11% stone fruit and 9% table grapes. Export volumes, particularly in tropical fruits such as mangoes and avocadoes, have been growing rapidly in recent years. The sector is highly sophisticated and is skilled at the refrigeration and packing required for European Union standards. With clarity now achieved on refrigeration protocols in China, South Africa intends increasing table grape exports to that country to R2.5-billion within five years. 61 SOUTH AFRICAN BUSINESS 2018

- Page 1 and 2:

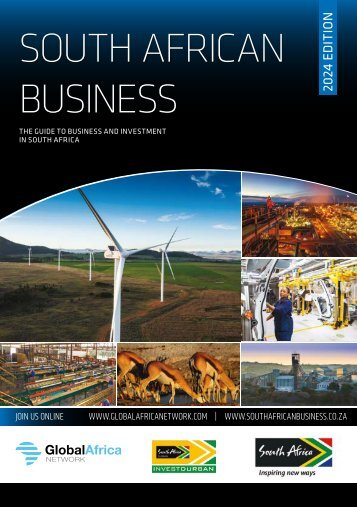

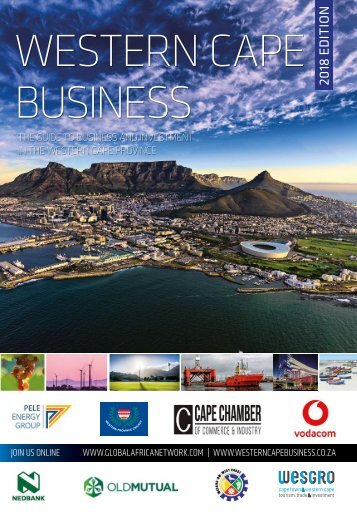

SOUTH AFRICAN 2018 EDITION BUSINESS

- Page 3 and 4:

SANSA provides stateof-the-art grou

- Page 5 and 6:

Doing business in Durban Durban has

- Page 7 and 8:

O&M CAPE TOWN 2382/E IT‘S NOT JUS

- Page 9 and 10:

A city so good you’ll want to inv

- Page 11 and 12: EPC IN POWER GENERATION Leaders in

- Page 14 and 15: SOUTH AFRICAN BUSINESS 2018 12

- Page 16 and 17: SPECIAL FEATURE Trends There are se

- Page 18 and 19: SPECIAL FEATURE The Orange and Vaal

- Page 20 and 21: MESSAGE City of Ekurhuleni Message

- Page 22 and 23: PROFILE a powerful distribution cen

- Page 24 and 25: Business expands into Africa Manufa

- Page 26 and 27: SPECIAL FEATURE Automotive opportun

- Page 28: FOCUS Export Credit Insurance Corpo

- Page 31 and 32: SPECIAL FEATURE beneficiation of al

- Page 34 and 35: SPECIAL FEATURE committed investmen

- Page 36 and 37: Skills development Job-relevant tra

- Page 38 and 39: SPECIAL FEATURE Roof maintenance sp

- Page 40 and 41: INTERVIEW Training at Work Founder

- Page 42 and 43: The hardest workers You shouldn’t

- Page 44 and 45: INTERVIEW Meeting national developm

- Page 46: PROFILE College of Cape Town The fo

- Page 49 and 50: SPECIAL FEATURE 47 SOUTH AFRICAN BU

- Page 51 and 52: SPECIAL FEATURE Local economic deve

- Page 53 and 54: SPECIAL FEATURE Cape, the Small Har

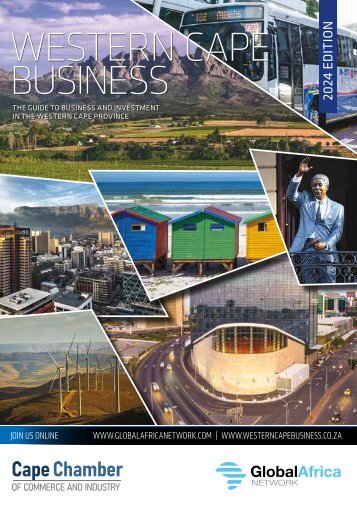

- Page 55 and 56: Western Cape The Port of Cape Town

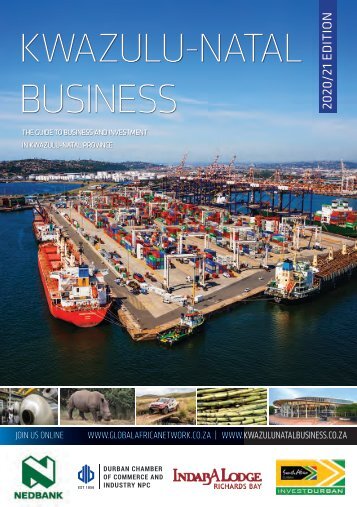

- Page 58 and 59: SPECIAL FEATURE KwaZulu-Natal With

- Page 61: KEY SECTORS Overviews of the main e

- Page 65: O&M CAPE TOWN 2382/E www.vwcommerci

- Page 68 and 69: OVERVIEW tive, working better with

- Page 70 and 71: OVERVIEW demand from the fuel cell

- Page 72: OVERVIEW Assets Most of the oil tha

- Page 75 and 76: Service that delivers the Differenc

- Page 77 and 78: How do you ensure security of suppl

- Page 79 and 80: OVERVIEW Whereas national utility E

- Page 81 and 82: Pele Natural Energy INTERVIEW Manag

- Page 83 and 84: Pele Green Energy INTERVIEW Renewab

- Page 85 and 86: PELE BRINGS POWER TO THE PEOPLE KNO

- Page 87 and 88: OVERVIEW The national Minister of W

- Page 89 and 90: OPTIMISED SOLUTIONS FOR THE ENTIRE

- Page 91 and 92: iX Engineers INTERVIEW CEO Lebo Les

- Page 93 and 94: Transforming South Africa’s engin

- Page 95 and 96: usiness line focuses on EPC enginee

- Page 97 and 98: OVERVIEW The National Department of

- Page 99: INTERVIEW Marley Pipe Systems Manag

- Page 103 and 104: O&M CAPE TOWN 2382/E Volkswagen Eco

- Page 105 and 106: Chemicals and pharmaceuticals Drug

- Page 107 and 108: PROFILE SYSPRO software is an award

- Page 109 and 110: OVERVIEW stock) and an investment c

- Page 111 and 112: INTERVIEW EKS Secure Technologies L

- Page 113 and 114:

DaySeven Group OVERVIEW Patrick Oor

- Page 115 and 116:

PROFILE facilitators who are qualif

- Page 117 and 118:

PROFILE The value of verification W

- Page 119 and 120:

OVERVIEW The Port of Cape Town has

- Page 121 and 122:

OVERVIEW private game farms and nat

- Page 123 and 124:

Take a wander through the 17 hectar

- Page 125 and 126:

O&M CAPE TOWN 2382/E Your ready-to-

- Page 128 and 129:

OVERVIEW Information and communicat

- Page 130 and 131:

OVERVIEW Banking and financial serv

- Page 132 and 133:

OVERVIEW Development finance and SM

- Page 134 and 135:

FOCUS Positive change through enter

- Page 136 and 137:

LISTING South African National Gove

- Page 138 and 139:

LISTING Department of Public Enterp

- Page 140:

LISTING Department of Water and San

- Page 143 and 144:

Nedbank, Standard Bank and Capitec

- Page 145 and 146:

REGION The Provincial Government of

- Page 147 and 148:

Key sectors The leading economic se

- Page 149 and 150:

OUTSTANDING INFRASTRUCTURE Efficien

- Page 151 and 152:

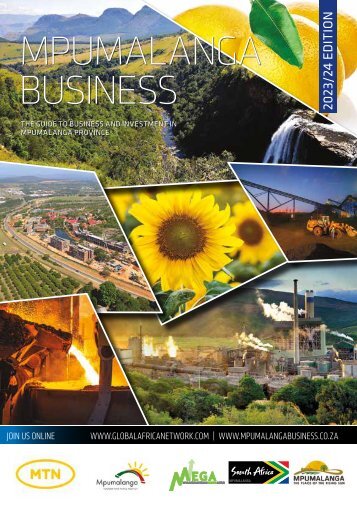

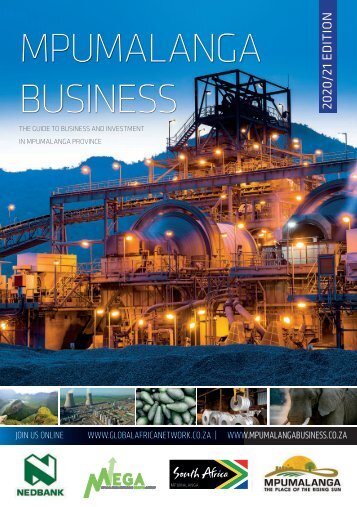

REGION and Bell Equipment are impor

- Page 153 and 154:

The De Hoop Dam across the Steelpoo

- Page 155 and 156:

REGION Most of the province receive

- Page 157 and 158:

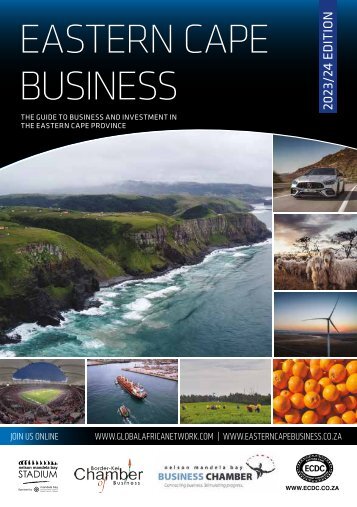

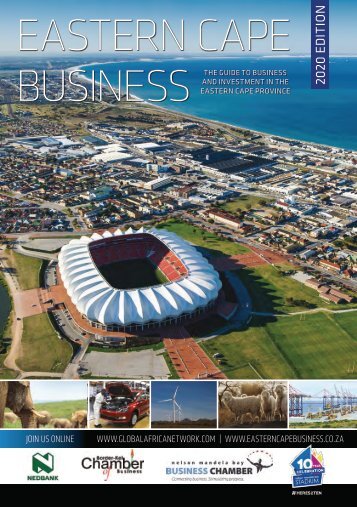

REGION fourth-largest wool-producin

- Page 159 and 160:

REGION involved in grain. Cattle an

- Page 161 and 162:

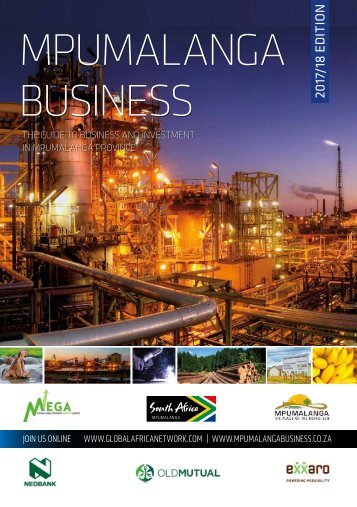

REGION Refined petroleum was the si

- Page 163:

these are not ur average Don’t on

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...