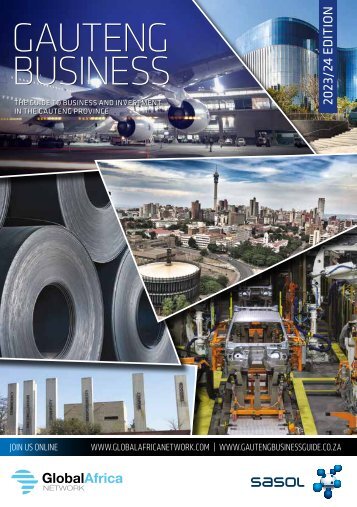

South African Business 2022

- Text

- Wwwglobalafricanetworkcom

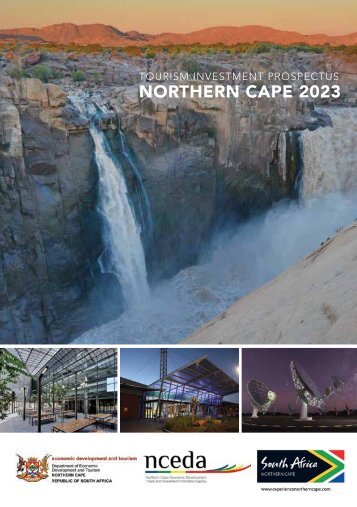

- Tourism

- Global

- Sector

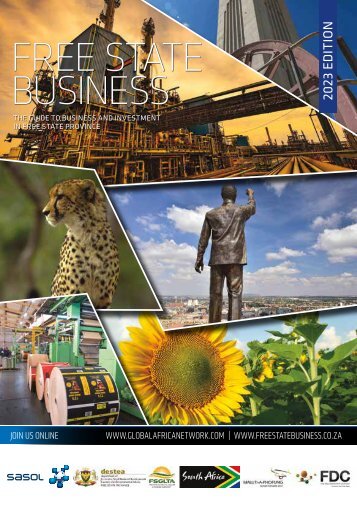

- Economy

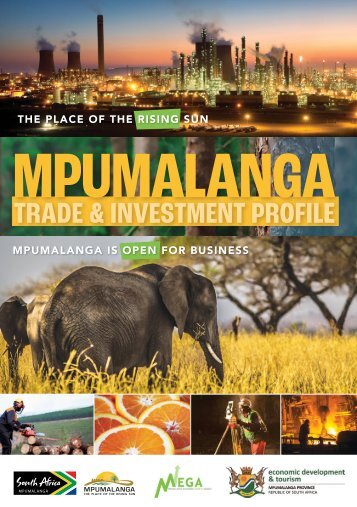

- Infrastructure

- Manufacturing

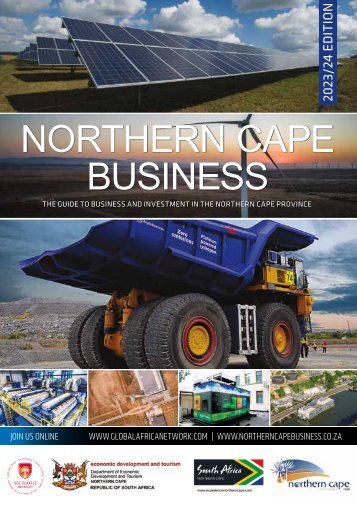

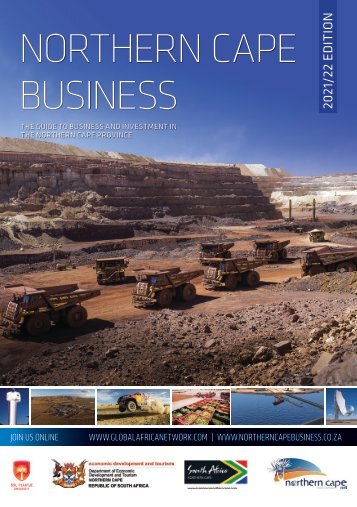

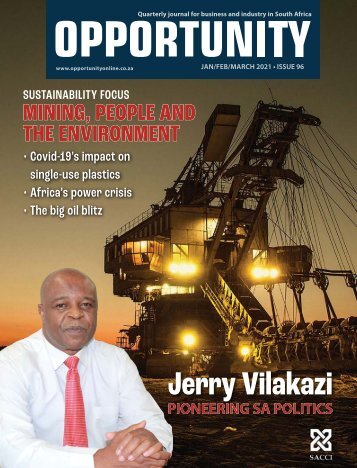

- Mining

- Cape

- Economic

- African

OVERVIEW Energy

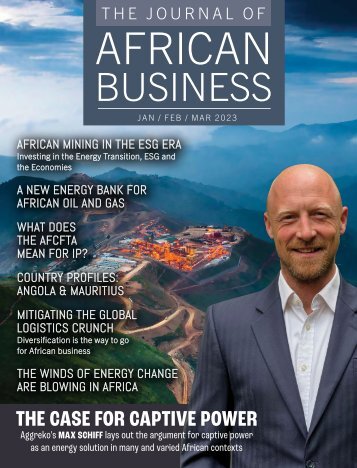

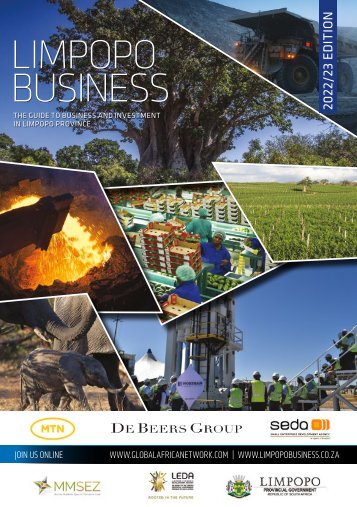

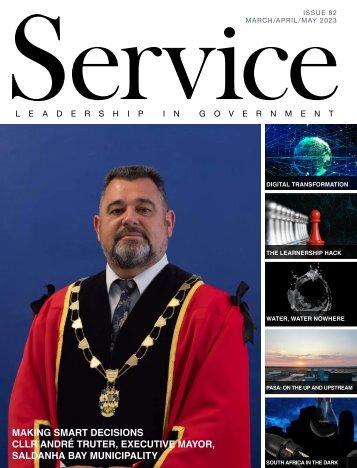

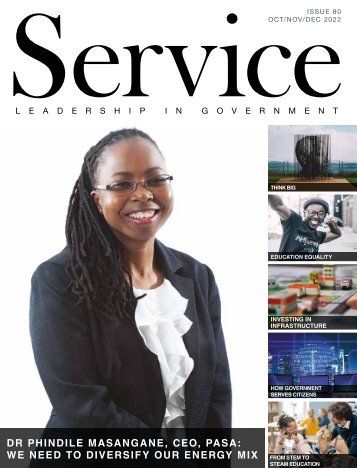

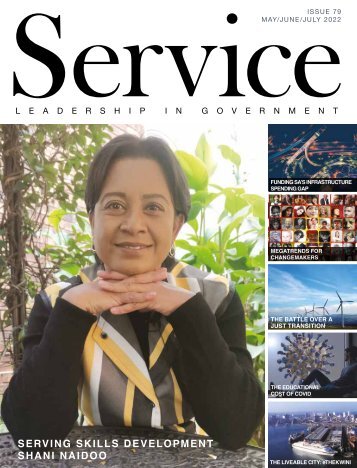

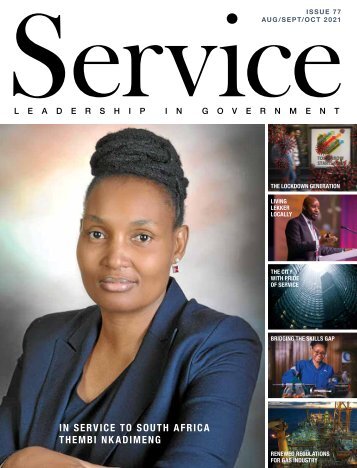

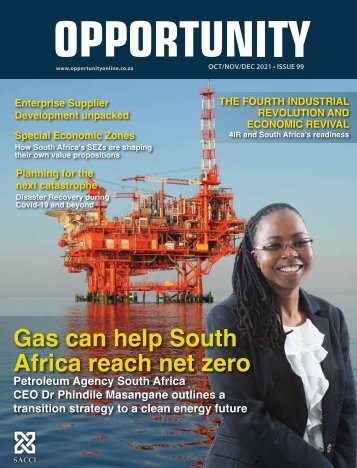

OVERVIEW Energy Generation exemption has changed the energy landscape. Medupi power station is one of the largest engineering projects in South Africa’s history. Credit: Eskom In June 2021 President Cyril Ramaphosa announced that private entities could go ahead and produce electricity without a licence, raising the threshold from 1MW to 100MW at a stroke. Intensive energy users such as mining houses had been arguing for this policy initiative for a long time, as had manufacturers in the sugar and timber milling industries, which produce vast amounts of biomass which can be turned into energy. The presidential announcement was almost universally welcomed by interested parties, including the CEO of national utility Eskom, which is struggling to keep South Africa supplied with sufficient power. Mining companies such as Sibanye-Stillwater and Gold Fields want to marshall renewable energy resources to power their own operations. Another big game-changer in the South African energy landscape will be the unbundling of Eskom. An Independent Transmission System and Market Operator was set to be established by 31 December 2021, assuming that all the documents are signed by that date. Companies such as Earth & Wire are preparing to become independent utilities in a more flexible energy environment. However, the move away from fossil fuels is not as straightforward as might be assumed. Despite the emphasis on renewables in South Africa’s latest integrated resources plan (IRP), South Africa’s energy mix is still weighted towards coal. Two huge new power stations, Kusile and Medupi, are being built by Eskom and 1 000MW has been allocated to private producers to build coal-powered stations. Koeberg nuclear power station is due to be decommissioned soon after 2045. The Minister of Mineral Resources and Energy, Gwede Mantashe, is a former coal miner and he has unapologetically argued the corner of the coal SECTOR INSIGHT A green hydrogen industry could transform South Africa. industry, pointing out that South Africa still has vast reserves of coal. This fact, and the need to make what has been called a “just transition” to green energy, underpin the creation of the Presidential Climate Change Coordinating Commission (PCCCC). Led by Valli Moosa, a former minister of the environment who famously campaigned against the proliferation of shopping bags, the PCCCC aims to look beyond the jobs lost by a switch to greener energy options and consider issues such as the effects of climate change on vulnerable communities. Renewable energy development zones (REDZ) are intended to contribute to mine rehabilitation and to support a just energy transition. SOUTH AFRICAN BUSINESS 2022 48

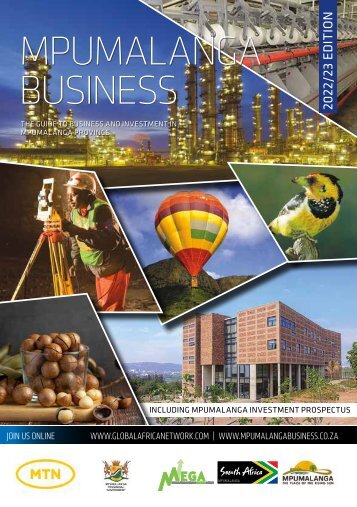

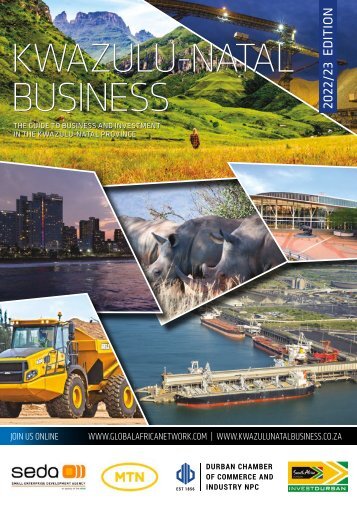

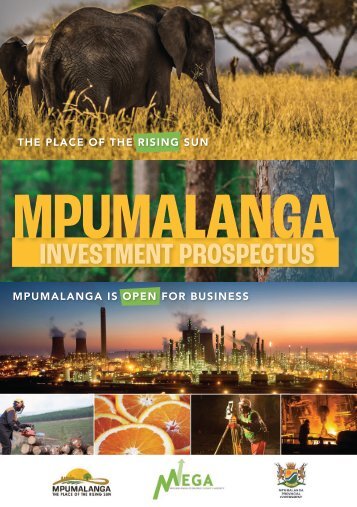

Hydrogen and hybrids One of Earth & Wire’s projects intends producing e-methanol by combining green hydrogen with a synthesis gas. Instead of using fossil fuels to make the e-methanol, this process will be powered by renewable energy and use elements such as seawater, biomass and solid waste. ENERTRAG South Africa, with experience around the world and in partnership with Sasol, are the technical partners on the project, which will be located in Humansdorp in the Eastern Cape where a number of wind farms are situated. South Africa’s huge reserves of platinum group metals (PGMs), allied to plentiful sun and wind, gives the country a headstart in terms of establishing a green hydrogen industry. Daily Maverick 168 ran a story at the end of July 2021 titled “Hydrogen economy may be a saviour”. The news article reported on the establishment of a R103-million PGM manufacturing facility in Gauteng by Isondo Precious Metals. The article quotes the acting chief director for Special Economic Zones (SEZs) in the Department of Trade, Industry and Competition (the dtic), Thami Klassen, welcoming the facility as it would be hosting “manufacturing processes of platinum group metal components for the fuel cell and electrolyser industries that underpin the emerging green hydrogen industry”. Production is expected to begin in the middle of 2022. A R2-billion hydrogen fuel cell project has begun in Mpumalanga under the leadership of Mashudu Ramano, a former chairman of several companies including Astron Energy. Seed funding has been provided by the Industrial Development Corporation (IDC) and the Development Bank of Southern Africa. Anglo American is investigating the feasibility of creating a “hydrogen valley” from its PGM mine in Limpopo to the coast of KwaZulu-Natal. One of the companies involved in the study, French firm Engie, estimates that the local market for green hydrogen could be R142-billion annually by 2040, with the export market worth 10 times that (Sunday Times). The 128MW Oya Energy Hybrid Facility being built near Matjiesfontein in the Western Cape is unusual. Falling within the Komsberg Renewable Energy Development Zone (REDZ), the project is owned by G7 renewable energies and will use a hybrid controller to dispatch power to the grid when it is needed from whichever of the technologies is producing power; wind turbines or solar PV arrays supported by lithium-ion batteries. ONLINE RESOURCES IPP projects: www.ipp-projects.co.za National Energy Regulator of South Africa: www.nersa.org.za South African Independent Power Producers Association: www.saippa.org.za South African Wind Energy Association: www.sawea.org.za Credit: BTE Renewables South Africa’s acclaimed Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) attracted about R200-billion in committed investments, mostly in solar and wind power, in just five years. Research has shown that there will be an electricity supply gap of approximately 2 000MW between 2019 and 2022. The Oya project is part of a more recent addition to the REIPPPP, the Risk Mitigation IPP Procurement Programme. A majority of wind projects have been allocated to the Eastern Cape, but approximately 60% of the solar projects so far allocated in the programme have been in the Northern Cape, the nation’s sunniest province. Projects such as Kathu Solar Park (100MW), a concentrating solar power (CSP) project, and the Roggeveld Wind Farm (147MW) are indicative of the large scale of most of the energy generation that is being rolled out. Gas is also in the mix. The Department of Energy is targeting the procurement of 3 126MW and intends spending R64-billion on port, pipeline, generation and transmission infrastructure at three key ports, Richards Bay, Coega and Saldanha Bay. ■ 49 SOUTH AFRICAN BUSINESS 2022

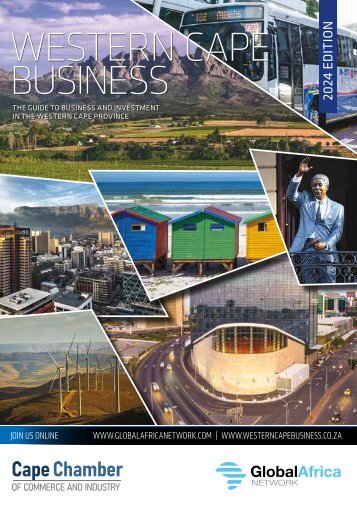

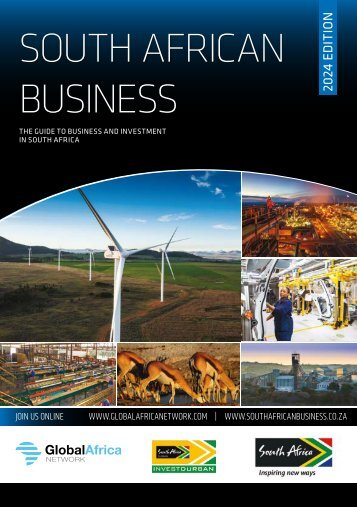

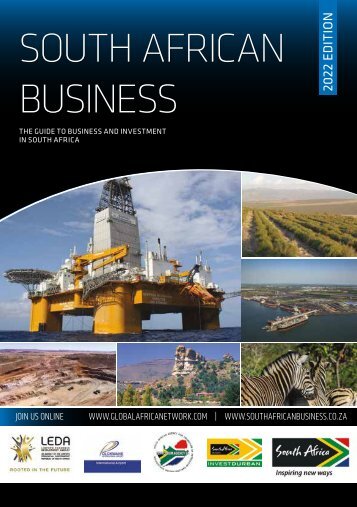

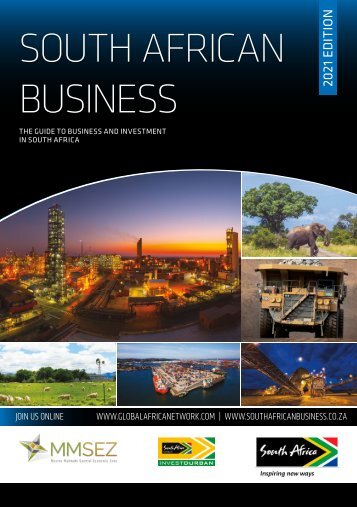

- Page 1: SOUTH AFRICAN BUSINESS 2022 EDITION

- Page 5 and 6: 0 0 11 1 0 1 0 11 0 0 11 1 0 1 0 11

- Page 7 and 8: f , t t r l . t we end the pandemic

- Page 9 and 10: GOING BEYOND? THAT’S IN OUR NATUR

- Page 11 and 12: South African Business A unique gui

- Page 13 and 14: SPECIAL FEATURE Bhorat’s conclusi

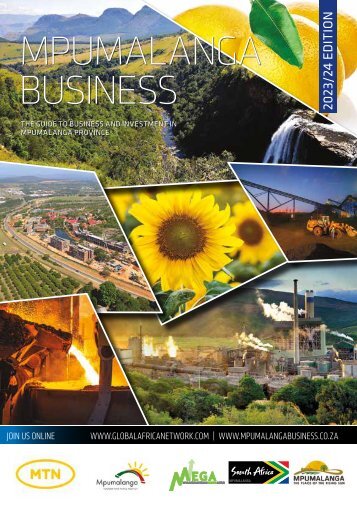

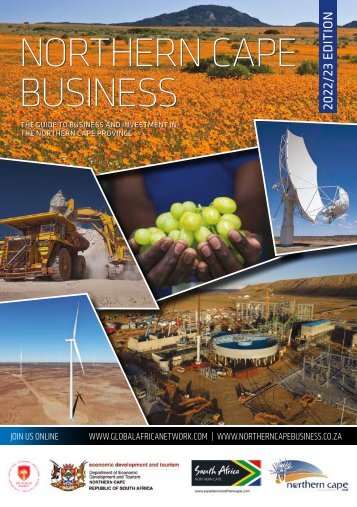

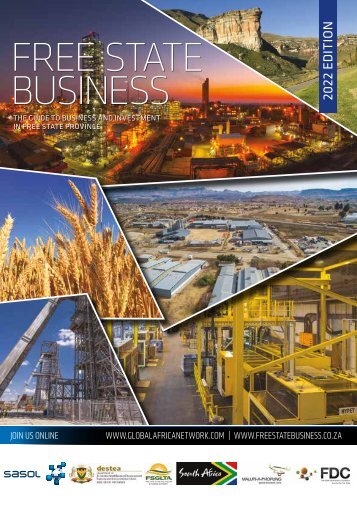

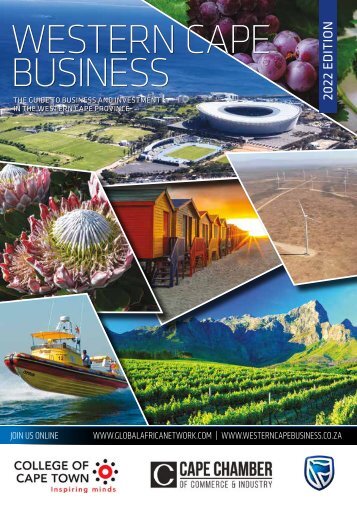

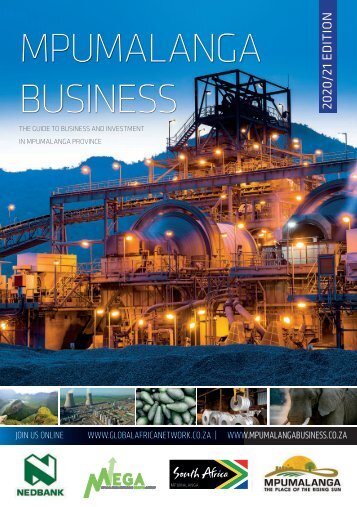

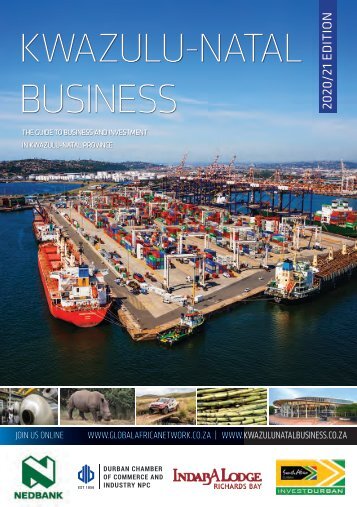

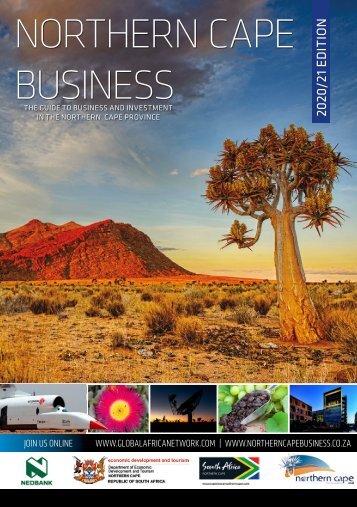

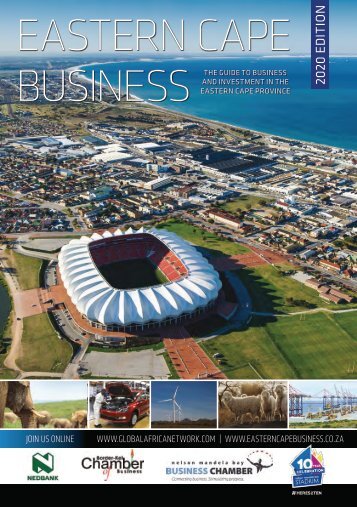

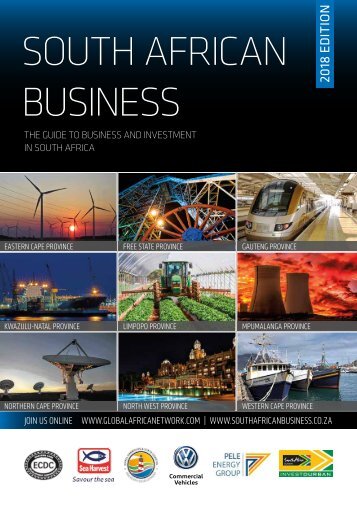

- Page 15 and 16: SPECIAL FEATURE Provinces of South

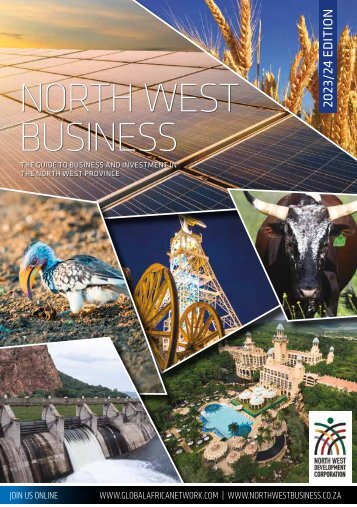

- Page 17 and 18: SPECIAL FEATURE SPECIAL FEATURE Nor

- Page 19 and 20: SPECIAL FEATURE • Auto-catalysts

- Page 21 and 22: 10 REASONS WHY YOU SHOULD INVEST IN

- Page 23 and 24: Deputy Minister oversight visit hig

- Page 25 and 26: Why businesses locate in the FT-SEZ

- Page 27 and 28: Targeted commodity clusters at Feta

- Page 29 and 30: ithout ff line FOCUS improvement in

- Page 31 and 32: ithout ff line FOCUS In this contex

- Page 33 and 34: Logo without pay-off line At Atlant

- Page 35 and 36: SPECIAL FEATURE include a carbon ca

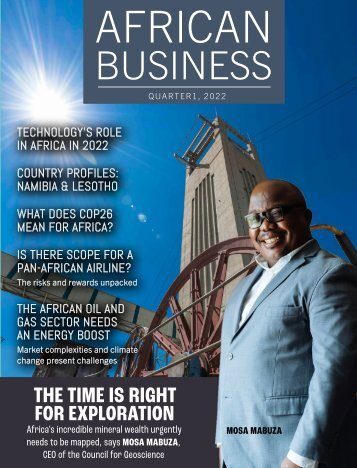

- Page 37 and 38: country at a scale of 1:250 000. Th

- Page 39 and 40: The Council for Geoscience has laun

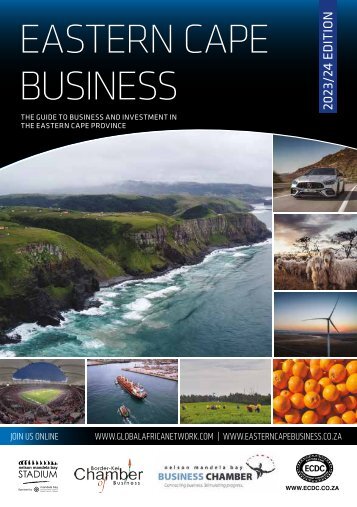

- Page 41 and 42: The eMendi building at Port of Ngqu

- Page 43 and 44: OVERVIEW Tourism (LEDET) is encoura

- Page 45 and 46: 2021/10/20 16:49:06 Sharing Africa

- Page 47 and 48: Sales and profits PPC Lime has chan

- Page 49: INTERVIEW cells. How do we massify

- Page 53 and 54: Source: Northern Cape GH2 Strategy

- Page 55 and 56: I N C E N T I V E S O F F E R E D B

- Page 57 and 58: Offshore gas finds could revitalise

- Page 59 and 60: asin off the south coast of the cou

- Page 61 and 62: OVERVIEW The project was gazetted a

- Page 63 and 64: INTERVIEW As part of our focus on c

- Page 65 and 66: OVERVIEW new industry in less than

- Page 67 and 68: OVERVIEW Manufacturing Vaccine manu

- Page 69 and 70: FOCUS Durban is South Africa’s po

- Page 71 and 72: FOCUS Commercial services resume at

- Page 73 and 74: INTERVIEW Finding the right talent

- Page 75 and 76: OVERVIEW ICT Covid-19 has increased

- Page 77 and 78: Banking and financial services 120

- Page 79 and 80: OVERVIEW included a Repayment Relie

- Page 81 and 82: PROFILE The value of verification W

- Page 83 and 84: AFRICAN BUSINESS THE GUIDE TO BUSIN

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...