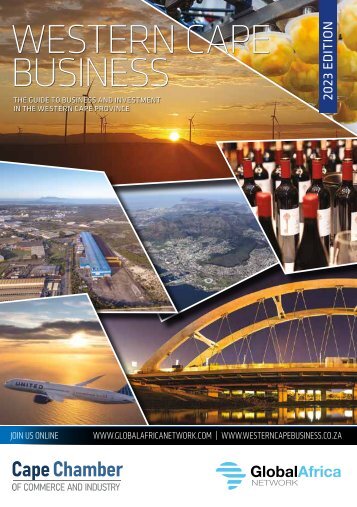

Western Cape Business 2023

- Text

- Bpo

- Roads

- Digital

- Business

- Investment

- Green hydrogen

- Resesarch

- Industrial

- Manufacturing

- Renewables

- Greentech

- Provincial

- Infrastructure

- Hydrogen

- Economy

- Renewable

- Economic

- African

- Sector

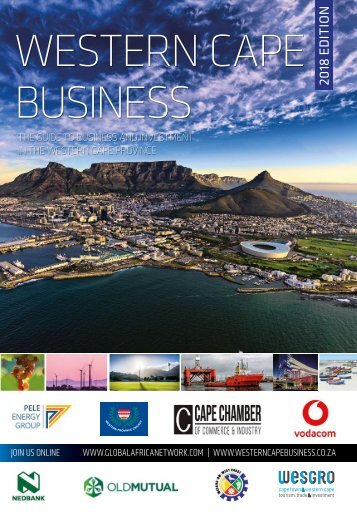

- Western

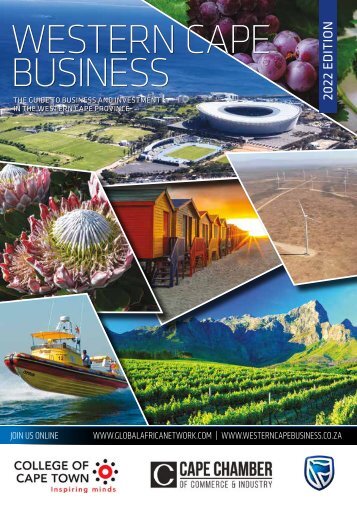

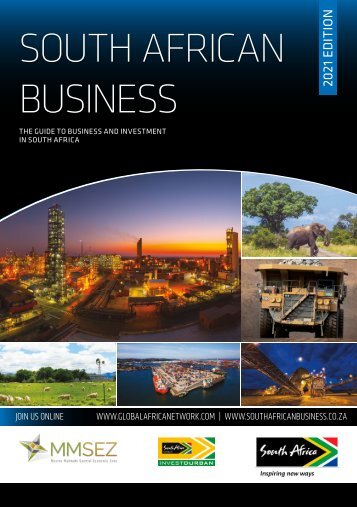

OVERVIEW Agriculture

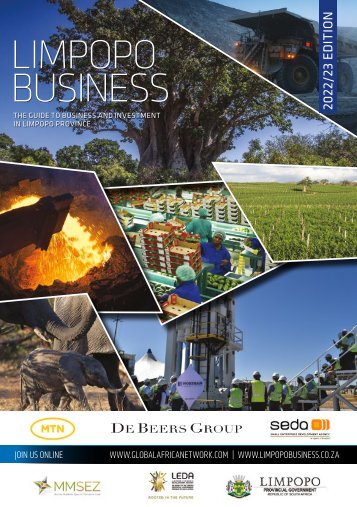

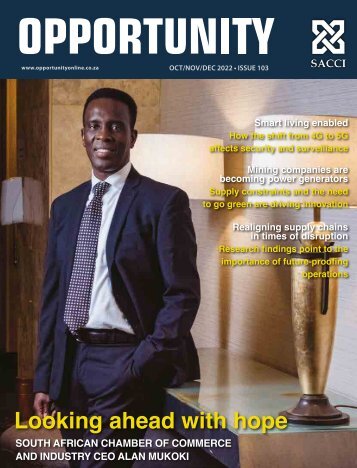

OVERVIEW Agriculture Farmers are trying to save a canning factory. Tiger Brands announced in 2020 that it intended focussing on what it called “everyday branded food and beverages”. The result of that focus is that the company’s food-canning business is to be put up for sale. Fears were raised in the town of Ashton that up to 4 000 jobs would be lost and 300 farmers in the district would be wiped out if Langeberg & Ashton Foods canning facility were to close. Ashton is in the Langeberg Local Municipality within the Cape Winelands District Municipality. The company is a subsidiary of Tiger Brands, the country’s biggest producer of food. A local consortium of 160 fruit farmers was considering trying to buy the facility. Agri SA estimated they would need an amount approaching R300-million. This was proving difficult to raise but in July 2022, Tiger said it would keep the operation going for one more season. Suiderland Plase managed to build and start operating a new citrus packhouse despite the disruptions of Covid-19 and tough market conditions. Named Bergpak, the packhouse, pictured, is designed to pack 120 000 bins of fruit per year from year three, and the volume could grow as high as 280 000 bins in a season. The facility is in the vicinity of Piketberg and is the company’s third packhouse. It will house a variety of citrus cultivars which will run on two six-lane sorters. At Wespak, near Clanwilliam, and Suiderpak (Swellendam), the packhouses deal with 70 000 and 60 000 bins respectively. The company grows, packs and markets fruit and recently has been expanding its plantings in soft citrus, lemons and table grapes. A fairly new growth area in agriculture is the production of liquid kelp products. Farmed kelp in Gansbaai is processed to create products that assist with root growth in crops. Afrikelp is a company that exports to more than 50 countries and claims that its products improve water and nutrient-use efficiency, together with equipping plants to better handle droughts. The South African Rooibos Council announced in 2022 that it would start paying a levy on the product to trusts for Khoi and San people. A payment of R12.2-million was paid in July and the future levy would amount to 1.5% of the farm gate price. This followed news that the long battle for protected status for rooibos in the EU finally reached an end. The best-known products that are forever linked to their home regions are champagne and SECTOR INSIGHT Liquid kelp products are doing well. port, and France and Portugal have fought hard for those rights. Now the Western Cape’s herbal tea product enjoys the same privileges, which is great news for the roughly 450 farmers working with rooibos (350 commercial plus 100 small-scale farmers). The sector produces about 20 000 tons of rooibos every year, about half of which is exported. Credit: Langeberg & Ashton Foods WESTERN CAPE BUSINESS 2023 22

OVERVIEW Economic impact Agribusiness and agro-processing are vital parts of the provincial economy with about 45% of South Africa’s agricultural exports moving through the province. The value-add in the sector amounts to more than R14-billion per annum (Invest Cape Town). Seven of the top 10 exports from the province are agricultural or agro-processed products. As Wesgro notes, the Western Cape is responsible for • Almost half of South Africa’s agribusiness exports • About 70% of South Africa’s beverages exports • About 85% of South Africa’s fisheries exports Agricultural products as a sector leads regional exports, second only to the petroleum sector. In addition, the region exports 70% of all South African beverages and spirits and 96% of its wine. The region produces 11 different commodities. Fruit, poultry, eggs, winter grains, viticulture and vegetables comprise more than 75% of total output. Exporters were introduced to some digital innovation in 2020 in the form of the Cape Export Network. CEN, a joint initiative of the Western ONLINE RESOURCES Aquaculture Association of Southern Africa: www.aasa-aqua.co.za Citrus Growers’ Association: www.cga.co.za Fresh Produce Exporters Forum: www.fpef.co.za South African Rooibos Council: www.sarooibos.co.za Western Cape Department of Agriculture: www.elsenburg.com Credit: Suiderland Plase Cape Provincial Government, Wesgro and Wines of South Africa (WoSA), is a platform that connects wine producers, buyers and importers. Assessed independently from the country, the Western Cape is the world’s fifth-largest exporter of citrus fruits. Oranges are the province’s number one citrus export and soft citrus is growing. Europe remains the most important market but the Asia and Oceana markets are growing. The top five countries are the Netherlands, UK, Russia, UAE and China. Berries are a growing subsector and two-thirds of production occurs in the Western Cape. More than 70% of the crop is exported and the major production companies are Berryworld South Africa, United Exports and Haygrove SA. Berries thrive between George and Swellendam and sales of chippers have grown because blueberries have to be vigorously pruned. There is plenty of scope for exports to grow. Current annual exports are 13 500t compared to over 200 000t for table grapes and about 300 000t for apples (South African Berry Producers’ Association). Once producers pass muster with Chinese import authorities, volumes can be expected to grow. ■ 23 WESTERN CAPE BUSINESS 2023

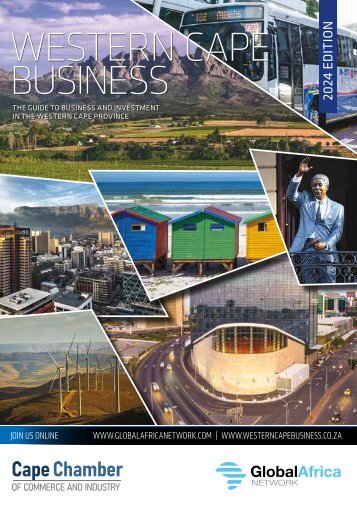

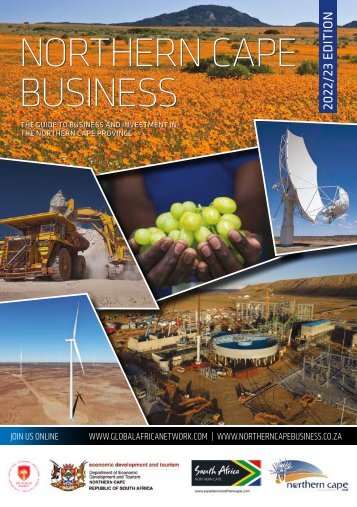

- Page 1 and 2: WESTERN CAPE BUSINESS THE GUIDE TO

- Page 3 and 4: Next-level connectivity. Groundbrea

- Page 5 and 6: Western Cape Business A unique guid

- Page 7 and 8: SPECIAL FEATURE roads. A Department

- Page 9 and 10: SHAPINGFUTURES How South African co

- Page 11 and 12: and water, by unlocking housing opp

- Page 13 and 14: The Western Cape has excellent pote

- Page 15 and 16: WECBOF makes it happen! The Western

- Page 17 and 18: SPECIAL FEATURE region, with Sasol

- Page 19 and 20: FOCUS Credit: Shutterstock fired by

- Page 21: www.capechamber.co.za We are immens

- Page 26 and 27: OVERVIEW Grapes and wine Logistics

- Page 28 and 29: OVERVIEW greater volumes. Which is

- Page 30 and 31: Oil and gas The Astron refinery is

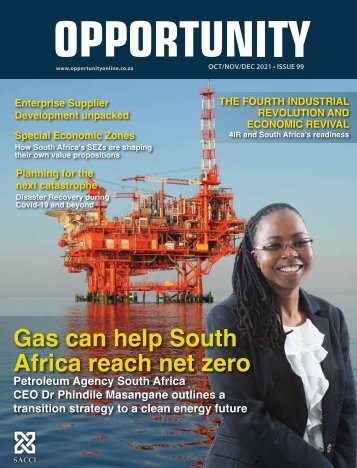

- Page 32 and 33: FOCUS Gas could bolster the Western

- Page 34 and 35: Energy Batteries could make a diffe

- Page 36 and 37: OVERVIEW Manufacturing Local clothe

- Page 38 and 39: OVERVIEW Transport and logistics Th

- Page 40 and 41: OVERVIEW Tourism Air Belgium has st

- Page 42: OVERVIEW Education Digital skills a

- Page 45 and 46: Shaping futures one education at a

- Page 47 and 48: Business Process Outsourcing Intern

- Page 49 and 50: The Evolution of loveLife 1999-2021

- Page 52: SCAN TO APPLY

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...